Getting ready for SaaS 2.0...

I've been advocating (& evangelizing) the SaaS alternatives to ASP-hosting models for the last few years, and firmly believe that it will be the proper accounting treatment of SaaS-architected client-server solutions on a capital-spending track (not consumed via browser, and therefore expensed) that will see the SaaS model truly explode. SaaS solutions that adhere to a customer-premise deployment & managed services subscription harness (ideally suited for .net), will rule the day & offer an improved TCO (Windows-Application Server Appliances are rapidly gaining ground) as an added discipline. It is already well understood by Enterprise Software experts, that software that profitably impacts customer workflows & business processes, needs to be customer-premised -- and alliances like the GXS/MSFT B2B grid solution are proving this point (thanks Eddie!)...

In pursuit of my above manifesto, I was fortunate to come across Bill McNee's similiar thoughts (and far more eloquent approach), and have excerpted them in full:

Get Ready for SaaS 2.0

A new study reveals seven key trends as software-as-a-service evolves beyond its current focus on cost-effective software application delivery toward an integrated business service provisioning platform.

By Bill McNee, Saugatuck Technology

May. 08, 2006

Software-as-a-Service (SaaS) is one of the most compelling and challenging IT and business innovations of the past two decades. Not surprisingly, SaaS is generating tremendous interest, heated debate, and a broad spectrum of opinion regarding its impact on users and vendors.

A new study from Saugatuck Technology, SaaS 2.0: Software-as-a-Service as Next-Gen Business Platform, shows that SaaS is at a fundamental "tipping point" between the current generation of software functionality delivered as a cost-effective service - or "SaaS 1.0" - and the emerging generation of blended software, infrastructure, and business services arrayed across multiple usage and delivery platforms and business models or "SaaS 2.0."

The move to SaaS 2.0 will bring with it new business trends and key points of caution for users and vendors alike.

What is the SaaS Shift?

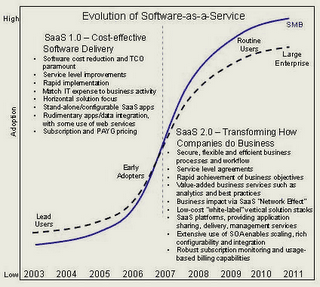

Saugatuck research indicates that SaaS adoption has begun a pronounced acceleration, particularly among small to mid-sized businesses (SMBs). This acceleration coincides with the emergence of the SaaS value proposition that Saugatuck refers to as SaaS 2.0. Figure 1 below illustrates this confluence of SaaS adoption and evolution.

Figure 1: Software-as-a-Service Evolution

Graph: Evolution of Software as a Service.

Source: Saugatuck Technology

While pundits similarly forecast rapid Application Service Provider (ASP) growth in the mid-to-late 1990s, hindsight indicates that the market was not yet ready for widespread adoption. Not only was the technology immature, with significant performance, security, customization and integration issues, but most user companies were not yet ready to buy mission-critical software as a hosted solution.

Further, the economics behind ASP single-tenancy models, including the lack of an aggressive on-demand, utility-style user environment, were just not compelling enough to tempt potential customers to make the leap to the new model in sufficient numbers to reach critical mass.

Three Cornerstones Support SaaS Adoption

Today, progress has been made across virtually every front. Saugatuck research and analysis indicates that SaaS is now entering a period of accelerated adoption, supported by three "cornerstone" business and technology factors.

First, the shift to SaaS 2.0 is being driven increasingly by the acceptance of SaaS as a viable software delivery model. User executives surveyed by Saugatuck indicate that 12 percent of U.S.-based companies have at least one major SaaS application installed (as of the first quarter 2006), with an additional 13 percent currently designing, prototyping or implementing their first SaaS application. Another 14 percent are planning to do so later in 2006 or in 2007. Given such strong adoption rates, Saugatuck expects continued strong provider growth over the next 18 months, especially among such leading and emerging SaaS application providers as Employease, NetSuite, PerfectCommerce, Right Now Technologies, and Salesforce.com.

Second, SMBs will lead SaaS 2.0 adoption (see Figure 1), after largely taking a "wait-and-see" attitude in the earlier part of this decade. Contrary to conventional wisdom at the time, Saugatuck's previous pay-as-you-go research found that large enterprises would be the most prevalent early SaaS adopters through 2005 - as many have sought to supplement existing enterprise applications, in addition to deploying point solutions. This latest research confirmed this trend, along with highlighting the "tipping point" toward accelerated SMB adoption 2006-2008. Most importantly, SMBs are now embracing SaaS for mission-critical workloads at twice the rate as large enterprises.

Third, due to the highly decentralized and fragmented procurement model of SaaS (often sold to business rather than IT buyers), Saugatuck found that most executives substantially underestimate current SaaS deployment and uasage, suggesting that the penetration rates noted above might be very conservative. Interviews with 40 U.S.-based user firms indicated that most executives at firms with greater than $1 billion in annual revenue initially believed that they had 3 to 5 SaaS applications deployed. Closer examination tended to reveal much greater SaaS presence, however. In fact, recent Sarbanes-Oxley compliance audits at two very large firms revealed that they had, respectively, 22 and more than 45 actively-deployed SaaS applications. Prior to the audits, they both believed that they had less than 10 actively deployed SaaS applications

SaaS 2.0: It's About Changing Business Platforms

To put it simply, SaaS 2.0 significantly extends and fundamentally changes what we think of and use as SaaS today. SaaS 2.0, for example, will incorporate advanced SOA and business process management technologies to provide a next-generation business management platform that competes with, and in many cases, replaces, traditional enterprise applications.

Figure 1 above lists the core changes that we're beginning to see as SaaS shifts to a more powerful position among user firms - and a more threatening position for many enterprise application vendors as the decade unfolds. These changes are reflected in the following seven key trends and attributes of SaaS 2.0:

1. Secure, flexible and efficient business processes and workflow. While cost effective software delivery and TCO have been key to the success of SaaS 1.0, the business drivers for SaaS 2.0 will be about helping users transform their business structures and processes. In this way, SaaS 2.0 has the potential to have much in common with Business Services Provisioning.

2. Service level agreements: While SaaS 1.0 offerings have delivered service level improvements in many cases, SaaS 2.0 will provide a much more robust infrastructure and application platform driven by Service Level Agreements (SLAs). This is fundamental due to the increasing focus on business mission-critical application delivery.

3. Rapid achievement of business objectives. Rather than SaaS being positioned and sold as a rapid implementation and deployment environment, SaaS 2.0 is much more about the rapid achievement of business objectives. In this sense, it is very clear that SaaS is not about the technology. The nuts and bolts infrastructure and application functionality that make up a solution is becoming much less important, while the business results that can be achieved and "getting the job done" are increasingly paramount.

4. Value-added business services. As core horizontal business application functionality delivered via SaaS becomes commoditized, vendors and service providers will increasingly differentiate with an array of value-add business service plug-ins (both programmable and non-programmable). In this way, SaaS 2.0 will deliver a blend of business process, application functionality, and managed services at an operational level. Effective management of the usage and benefits of such services requires consulting and analytics - delivered as part of the overall SaaS bundle. SaaS Integration Platforms (SIPs) will emerge as vendors, consultancies, and VARs learn how to bundle and deliver these critical, value-added capabilities.

5. Business impact via SaaS "Network Effect." Saugatuck defines the network effect of SaaS 2.0 as a cascading and radiating impact of business improvement and change within, across, and beyond the user enterprise. In other words, SaaS 2.0 deployment increases and improves choices, efficiencies, effectiveness, and business capabilities within the user enterprise, and between the enterprise and its suppliers, customers and business partners. New business opportunities emerge as a result of SaaS adoption and integration into user business operations.

6. Low-cost "white-label" vertical solution stacks. The business and technological flexibility and managed services aspects of SaaS 2.0 will engender a slew of custom, vertically-oriented solutions that will be used by SMBs, including firms below the 1000-employee/$250M revenue line (that have often eluded enterprise application vendors). When enterprise vendors begin delivering such SaaS 2.0 solutions, VARs - long the SMB channel of choice for enterprise vendors - will increasingly view those vendors as direct competitors. While many VARs will continue to act as channel partners, providing local/regional service and support - others will build or re-label competitive SaaS 2.0 vertical solutions, often using open source-based software and SOA standard components to reduce development costs and improve standardization and adaptability for customers.

7. SaaS Integration Platforms provide application sharing, delivery and management services. As users add SaaS applications over time, SIPs will play a critical role (especially in large enterprises) as a solution "hub" that provides integration, delivery, and management services. While IBM and Microsoft are well suited to this task, a number of emerging players are already well positioned, including offerings from Jamcracker (Pivot Path), OpSource (Optimal On-Demand), and Salesforce.com (AppExchange) - as did the recently-defunct Grand Central Communications that was heavily focused on providing a web services-based SaaS development and integration platform. On top of this are a long list of point solutions and management offerings across the entire technology stack.

SaaS 2.0 is About Business, not Technology

In sum, SaaS 2.0 goes well beyond today's SaaS business drivers, which have focused on cost-effective software delivery. Instead SaaS 2.0 is about helping users transform their business workflow and processes, and the way they do business. Along this road, Saugatuck's scenario-driven research (and IT history) suggests that SaaS will come in many forms and flavors, depending on market and industry segmentation.

To this end, we suggest three key points of caution for users and vendors alike:

* First, the relatively low ranking of "pre-existing vendor relationships" as a key priority among executives that we spoke to when selecting SaaS providers (10th on a list led by Price, TCO, Ease of doing business and Vendor Reputation) should be viewed as an important warning signal to existing software vendors. They need to be careful not to think about SaaS as merely a line-extension or delivery option, but instead view SaaS 2.0 as a new way of creating value that may in fact cannibalize traditional enterprise software lines of business.

* Second, in our judgement SaaS providers need to be careful not to apply a one-size-fits-all deployment and licensing model (founded on the principals of net-native, pay-for-service, multi-tenancy) for all customer segments. While a completely leveragable framework might work well for SMBs, large enterprises will have much more demanding requirements for flexibility in how they want to deploy, pay for, upgrade, integrate and customize their SaaS applications. Providing customers with choice will be the rule of the day.

* Third, building effective sales channels (SI, ISV and VAR) will be critical to SaaS adoption growth, as companies will still require significant application and data integration with their IT environment. Non-traditional channels (e.g., banks, telcos, web portals) will become key success factors for many SaaS solution categories, especially when targeting SMBs.

The bottom line? SaaS 2.0 is about changing business, and enabling new business. For users and for software and services vendors, success will be in the balance achieved by both in using and managing SaaS 2.0.

Bill McNee leads Saugatuck Technology's market strategy consulting practice as its Founder and CEO. The firm's new report, SaaS 2.0: Software-as-a-Service as Next-Gen Business Platform, co-authored with Mark Koenig and Bruce Guptill, has just been released and is available by visiting their website at www.saugatech.com/239order.htm. For further information, visit www.saugatech.com or call 1-203-454-3900.

In pursuit of my above manifesto, I was fortunate to come across Bill McNee's similiar thoughts (and far more eloquent approach), and have excerpted them in full:

Get Ready for SaaS 2.0

A new study reveals seven key trends as software-as-a-service evolves beyond its current focus on cost-effective software application delivery toward an integrated business service provisioning platform.

By Bill McNee, Saugatuck Technology

May. 08, 2006

Software-as-a-Service (SaaS) is one of the most compelling and challenging IT and business innovations of the past two decades. Not surprisingly, SaaS is generating tremendous interest, heated debate, and a broad spectrum of opinion regarding its impact on users and vendors.

A new study from Saugatuck Technology, SaaS 2.0: Software-as-a-Service as Next-Gen Business Platform, shows that SaaS is at a fundamental "tipping point" between the current generation of software functionality delivered as a cost-effective service - or "SaaS 1.0" - and the emerging generation of blended software, infrastructure, and business services arrayed across multiple usage and delivery platforms and business models or "SaaS 2.0."

The move to SaaS 2.0 will bring with it new business trends and key points of caution for users and vendors alike.

What is the SaaS Shift?

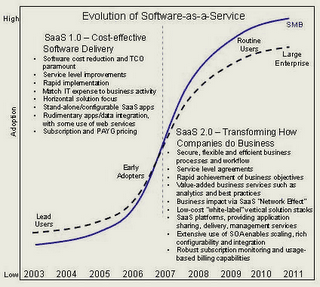

Saugatuck research indicates that SaaS adoption has begun a pronounced acceleration, particularly among small to mid-sized businesses (SMBs). This acceleration coincides with the emergence of the SaaS value proposition that Saugatuck refers to as SaaS 2.0. Figure 1 below illustrates this confluence of SaaS adoption and evolution.

Figure 1: Software-as-a-Service Evolution

Graph: Evolution of Software as a Service.

Source: Saugatuck Technology

While pundits similarly forecast rapid Application Service Provider (ASP) growth in the mid-to-late 1990s, hindsight indicates that the market was not yet ready for widespread adoption. Not only was the technology immature, with significant performance, security, customization and integration issues, but most user companies were not yet ready to buy mission-critical software as a hosted solution.

Further, the economics behind ASP single-tenancy models, including the lack of an aggressive on-demand, utility-style user environment, were just not compelling enough to tempt potential customers to make the leap to the new model in sufficient numbers to reach critical mass.

Three Cornerstones Support SaaS Adoption

Today, progress has been made across virtually every front. Saugatuck research and analysis indicates that SaaS is now entering a period of accelerated adoption, supported by three "cornerstone" business and technology factors.

First, the shift to SaaS 2.0 is being driven increasingly by the acceptance of SaaS as a viable software delivery model. User executives surveyed by Saugatuck indicate that 12 percent of U.S.-based companies have at least one major SaaS application installed (as of the first quarter 2006), with an additional 13 percent currently designing, prototyping or implementing their first SaaS application. Another 14 percent are planning to do so later in 2006 or in 2007. Given such strong adoption rates, Saugatuck expects continued strong provider growth over the next 18 months, especially among such leading and emerging SaaS application providers as Employease, NetSuite, PerfectCommerce, Right Now Technologies, and Salesforce.com.

Second, SMBs will lead SaaS 2.0 adoption (see Figure 1), after largely taking a "wait-and-see" attitude in the earlier part of this decade. Contrary to conventional wisdom at the time, Saugatuck's previous pay-as-you-go research found that large enterprises would be the most prevalent early SaaS adopters through 2005 - as many have sought to supplement existing enterprise applications, in addition to deploying point solutions. This latest research confirmed this trend, along with highlighting the "tipping point" toward accelerated SMB adoption 2006-2008. Most importantly, SMBs are now embracing SaaS for mission-critical workloads at twice the rate as large enterprises.

Third, due to the highly decentralized and fragmented procurement model of SaaS (often sold to business rather than IT buyers), Saugatuck found that most executives substantially underestimate current SaaS deployment and uasage, suggesting that the penetration rates noted above might be very conservative. Interviews with 40 U.S.-based user firms indicated that most executives at firms with greater than $1 billion in annual revenue initially believed that they had 3 to 5 SaaS applications deployed. Closer examination tended to reveal much greater SaaS presence, however. In fact, recent Sarbanes-Oxley compliance audits at two very large firms revealed that they had, respectively, 22 and more than 45 actively-deployed SaaS applications. Prior to the audits, they both believed that they had less than 10 actively deployed SaaS applications

SaaS 2.0: It's About Changing Business Platforms

To put it simply, SaaS 2.0 significantly extends and fundamentally changes what we think of and use as SaaS today. SaaS 2.0, for example, will incorporate advanced SOA and business process management technologies to provide a next-generation business management platform that competes with, and in many cases, replaces, traditional enterprise applications.

Figure 1 above lists the core changes that we're beginning to see as SaaS shifts to a more powerful position among user firms - and a more threatening position for many enterprise application vendors as the decade unfolds. These changes are reflected in the following seven key trends and attributes of SaaS 2.0:

1. Secure, flexible and efficient business processes and workflow. While cost effective software delivery and TCO have been key to the success of SaaS 1.0, the business drivers for SaaS 2.0 will be about helping users transform their business structures and processes. In this way, SaaS 2.0 has the potential to have much in common with Business Services Provisioning.

2. Service level agreements: While SaaS 1.0 offerings have delivered service level improvements in many cases, SaaS 2.0 will provide a much more robust infrastructure and application platform driven by Service Level Agreements (SLAs). This is fundamental due to the increasing focus on business mission-critical application delivery.

3. Rapid achievement of business objectives. Rather than SaaS being positioned and sold as a rapid implementation and deployment environment, SaaS 2.0 is much more about the rapid achievement of business objectives. In this sense, it is very clear that SaaS is not about the technology. The nuts and bolts infrastructure and application functionality that make up a solution is becoming much less important, while the business results that can be achieved and "getting the job done" are increasingly paramount.

4. Value-added business services. As core horizontal business application functionality delivered via SaaS becomes commoditized, vendors and service providers will increasingly differentiate with an array of value-add business service plug-ins (both programmable and non-programmable). In this way, SaaS 2.0 will deliver a blend of business process, application functionality, and managed services at an operational level. Effective management of the usage and benefits of such services requires consulting and analytics - delivered as part of the overall SaaS bundle. SaaS Integration Platforms (SIPs) will emerge as vendors, consultancies, and VARs learn how to bundle and deliver these critical, value-added capabilities.

5. Business impact via SaaS "Network Effect." Saugatuck defines the network effect of SaaS 2.0 as a cascading and radiating impact of business improvement and change within, across, and beyond the user enterprise. In other words, SaaS 2.0 deployment increases and improves choices, efficiencies, effectiveness, and business capabilities within the user enterprise, and between the enterprise and its suppliers, customers and business partners. New business opportunities emerge as a result of SaaS adoption and integration into user business operations.

6. Low-cost "white-label" vertical solution stacks. The business and technological flexibility and managed services aspects of SaaS 2.0 will engender a slew of custom, vertically-oriented solutions that will be used by SMBs, including firms below the 1000-employee/$250M revenue line (that have often eluded enterprise application vendors). When enterprise vendors begin delivering such SaaS 2.0 solutions, VARs - long the SMB channel of choice for enterprise vendors - will increasingly view those vendors as direct competitors. While many VARs will continue to act as channel partners, providing local/regional service and support - others will build or re-label competitive SaaS 2.0 vertical solutions, often using open source-based software and SOA standard components to reduce development costs and improve standardization and adaptability for customers.

7. SaaS Integration Platforms provide application sharing, delivery and management services. As users add SaaS applications over time, SIPs will play a critical role (especially in large enterprises) as a solution "hub" that provides integration, delivery, and management services. While IBM and Microsoft are well suited to this task, a number of emerging players are already well positioned, including offerings from Jamcracker (Pivot Path), OpSource (Optimal On-Demand), and Salesforce.com (AppExchange) - as did the recently-defunct Grand Central Communications that was heavily focused on providing a web services-based SaaS development and integration platform. On top of this are a long list of point solutions and management offerings across the entire technology stack.

SaaS 2.0 is About Business, not Technology

In sum, SaaS 2.0 goes well beyond today's SaaS business drivers, which have focused on cost-effective software delivery. Instead SaaS 2.0 is about helping users transform their business workflow and processes, and the way they do business. Along this road, Saugatuck's scenario-driven research (and IT history) suggests that SaaS will come in many forms and flavors, depending on market and industry segmentation.

To this end, we suggest three key points of caution for users and vendors alike:

* First, the relatively low ranking of "pre-existing vendor relationships" as a key priority among executives that we spoke to when selecting SaaS providers (10th on a list led by Price, TCO, Ease of doing business and Vendor Reputation) should be viewed as an important warning signal to existing software vendors. They need to be careful not to think about SaaS as merely a line-extension or delivery option, but instead view SaaS 2.0 as a new way of creating value that may in fact cannibalize traditional enterprise software lines of business.

* Second, in our judgement SaaS providers need to be careful not to apply a one-size-fits-all deployment and licensing model (founded on the principals of net-native, pay-for-service, multi-tenancy) for all customer segments. While a completely leveragable framework might work well for SMBs, large enterprises will have much more demanding requirements for flexibility in how they want to deploy, pay for, upgrade, integrate and customize their SaaS applications. Providing customers with choice will be the rule of the day.

* Third, building effective sales channels (SI, ISV and VAR) will be critical to SaaS adoption growth, as companies will still require significant application and data integration with their IT environment. Non-traditional channels (e.g., banks, telcos, web portals) will become key success factors for many SaaS solution categories, especially when targeting SMBs.

The bottom line? SaaS 2.0 is about changing business, and enabling new business. For users and for software and services vendors, success will be in the balance achieved by both in using and managing SaaS 2.0.

Bill McNee leads Saugatuck Technology's market strategy consulting practice as its Founder and CEO. The firm's new report, SaaS 2.0: Software-as-a-Service as Next-Gen Business Platform, co-authored with Mark Koenig and Bruce Guptill, has just been released and is available by visiting their website at www.saugatech.com/239order.htm. For further information, visit www.saugatech.com or call 1-203-454-3900.

Comments